VAT Refund

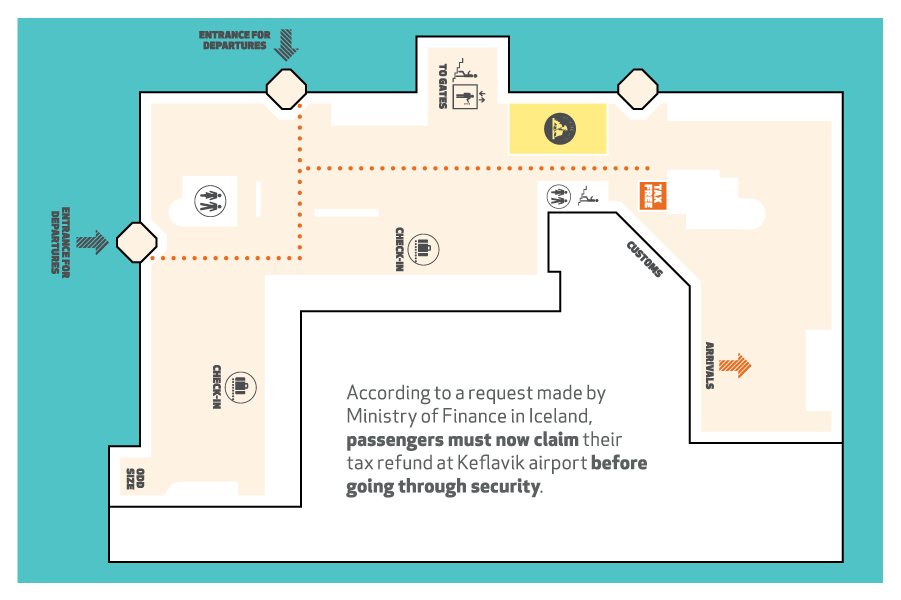

You can have your value added tax (VAT) refunded at Keflavík Airport at Arion bank wich is located in the arrivals hall of the airport. Passengers are to fetch their refund

before checking in and must be ready to show the goods for which they are claiming a refund. Opening hours match flight schedules.

are met.

Conditions for reimbursement according to regulation are that the purchaser of the goods has permanent residence in a country other than Iceland. As proof of

permanent residence overseas, the purchaser must submit his passport or other ID that provides proof of domicile in another country. Foreigners with permanent

residence in Iceland are not entitled to VAT refunds according to the regulation.

All the following conditions must be met in order to receive a refund.

The purchaser must take the product with him out of the country within three months from the date that the product was purchased.

The purchase price of the item including VAT must be at least ISK 12,000.

The item must be shown together with the requisite documentation on departure.

VAT may be refunded on goods on the same receipt if their total purchase price is ISK 12,000 or more, including VAT, even if one or more items does not reach the

requisite minimum amount.

On departure from Iceland through Keflavík International Airport, the buyer shall present the goods, together with the reimbursement documentation, to the refunding

entity, who will execute the refund, provided that the conditions set in the regulation are met in other respects. The refunding entity may not refund the VAT unless

the buyer can provide adequate evidence of permanent residence overseas.

Few things to keep in mind...

The buyer needs to be a resident of another country

The buyer brings the goods out of the country within three months from the purchase date

The purchase price of the goods with VAT is a minimum of ISK 12,000

The buyer needs to be able to produce the articles at departure

The buyer of the articles is the one daparting

If you did not claim the VAT before departure you cannot send the receipts or VAT claim for to Iceland!

before checking in and must be ready to show the goods for which they are claiming a refund. Opening hours match flight schedules.

Rules on VAT refunds

Value added tax (VAT) may be refunded to parties with permanent residence overseas for goods they have bought in Iceland, provided the conditions of the regulationare met.

Conditions for reimbursement according to regulation are that the purchaser of the goods has permanent residence in a country other than Iceland. As proof of

permanent residence overseas, the purchaser must submit his passport or other ID that provides proof of domicile in another country. Foreigners with permanent

residence in Iceland are not entitled to VAT refunds according to the regulation.

All the following conditions must be met in order to receive a refund.

The purchaser must take the product with him out of the country within three months from the date that the product was purchased.

The purchase price of the item including VAT must be at least ISK 12,000.

The item must be shown together with the requisite documentation on departure.

VAT may be refunded on goods on the same receipt if their total purchase price is ISK 12,000 or more, including VAT, even if one or more items does not reach the

requisite minimum amount.

On departure from Iceland through Keflavík International Airport, the buyer shall present the goods, together with the reimbursement documentation, to the refunding

entity, who will execute the refund, provided that the conditions set in the regulation are met in other respects. The refunding entity may not refund the VAT unless

the buyer can provide adequate evidence of permanent residence overseas.

Few things to keep in mind...

The buyer needs to be a resident of another country

The buyer brings the goods out of the country within three months from the purchase date

The purchase price of the goods with VAT is a minimum of ISK 12,000

The buyer needs to be able to produce the articles at departure

The buyer of the articles is the one daparting

If you did not claim the VAT before departure you cannot send the receipts or VAT claim for to Iceland!

1Do I need a customs stamp on my form to get a refund?

Yes, you always need a stamp for validate the Tax-free refund. Purchase between 12,000 and 100,000 ISK are stamped by Arion bank. Purchase higher than 100,000 must be stamped by Customs.

2Where do I get the stamp? Where is the customs office?

Where you get the stamp depends on where you departure

In Keflavik Airport the office is just after the check-in table, across the hall from the cafeteria.

In Seyðisfjörður the main office is the ferry terminal.

For sailboats, cruise ships, private aircrafts and other vessels customs officers arrive on board for the customs clearance before departure, according to appointments made by the vessels captain.

3Further information on tax free shopping in Iceland: